SSL has established a few diverse centres in Petaling Jaya. Business registration No.

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Companies Commission of Malaysia SSM Malaysian Registrar of Societies ROS FYI its compulsory for every NGO bodies to be registered with the Registrar of Societies ROS.

. With effect from the YA 2020 the restriction on that allowable deduction is increased to 10 of the aggregate income of an individual. CIMB 8000-7929-08 MERCY Humanitarian Fund. Accepting donations from subsidiaries of which the institution or organisation held more than 49 of the paid up capital.

Fines and penalties are generally not deductible. Individually we may not able to change the world but together we strive to help individuals and. Cash donation paid to approved institutions or organisations Gift of money orcontiibutioninLkino to any sports activity or approved 700 OF sports body Gift of moneyorcostofcontribution AGGREGATE INCOME in-kind to any project of national interest approved by the Finance Minister Gift of artifacts manuscripts or aintings NONE.

The deduction is limited to 10 of the aggregate income of that company for a year of assessment. Investing in subsidiaries with the total number of shares held not exceeding 49 total paid up capital. TYPES OF INSTITUTIONS OR ORGANISATIONS ELIGIBLE TO APPLY FOR APPROVAL UNDER SUBSECTION 446 OF THE ITA 1967 An institution or.

Established in 2010 Great Heart Charity Association ROS Registration No. There are two websites you can visit to find out the validity of any NGO bodies. Thank you for supporting MERCY Malaysia.

Based on the revised guidelines the donor is required to provide complete information of the details stipulated below in order to obtain an official receipt or tax-exemption receipt from the approved institution or organization. PPM-021-10-01072013 is a non-profit charitable organisation in Malaysia. Channel your donations to Malaysian Relief Agency Foundation CIMB Bank.

A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment. Gift of money or cost of contribution in kind for any Approved Sports Activity or Sports Body. Floods or through their website.

Payment Type Personal Info. Get it checked at an official website. So if anyone is approaching you for donation.

Ahmad has an aggregate income of RM60000 and makes a donation of RM5000 to an approved institution in March 2021. Amount is limited to 7 of aggregate income Subsection 44 11B 4. Amount is limited to 10 of aggregate income Subsection 446 3.

Gift of money or cost of contribution in kind for any Approved Project of National Interest Approved by Ministry of Finance. Bear in mind that the donation amount eligible for deduction is limited to 7 percent of ones aggregate income. During the Winter Light of Hope for Syria 80 Mission in December 2021 the KHOM team made an unexpected visit to the Jordanian Centre of Hearing and Speech in Irbid Jordan.

The same group that created Fugee School Malaysia launched Payong. Payong aids in bridging the gap among disadvantaged people including refugees in Malaysia and those eager to. That means if your aggregate income is 50000 you can donate up to 3500 for.

BEEN APPROVED UNDER SUBSECTION 44 6 of the ITA 1967 An approved institution or organisation is prohibited from. They achieve this by fostering the notion that everyone is a part of a single common humanity. Donations to charitable institutions.

MBB 5621-7950-4126 Cash or Cheque payable to MERCY Malaysia or MERCY Humanitarian Fund delivered to our office. US1 bil RM42 bil. The centre has been continuing its mission to provide subsidised haemodialysis service to the underprivileged society since 1994.

We aim to provide assistance to the needy that is both substantial and meaningful assistance. The MRA is a humanitarian organisation in Malaysia with a primary objective of assisting those affected by natural disasters or armed conflicts both local and abroad. For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of.

And you must keep the receipt of the donation. With the recent unveiling of a RM26 billion political donation received by the Prime Minister Datuk Seri Najib Tun Razak prior to the 13 th general election lets take a look how other countries in the world are faring when it comes to political donations. Gift of money or cost of contribution in kind for any Approved Sports Activity or Sports Body.

Sau Seng Lum is a leading non-profit health system in Malaysia. Under subsection 44 of Income Tax Act 1967 gifts of money to Approved Institutions or Organizations is allowable deduction from aggregate income. Gift of money to Approved Institutions or Organisations.

Amount is limited to 7 of aggregate income. They want to change Malaysias approach to the refugee situation. Youre 3 simple steps away from helping us to respond faster and better to the people in time of need.

For cash donations or direct transfer into our account please fax or email us your. United States 2014 Election. The charitable institution organisation must spend at least 50 or such percentage as may be determined by the Director General of its income including donation received in the previous year for the activities which were approved to achieve its objectives for the basis period for a.

Heres quick scenario to briefly illustrate how the whole thing works. Gift of money made to any approved institution organization or fund approved by the DGIR is also allowed as a deduction but restricted to 7 of the aggregate income of an individual. Since donations were pouring in for the mission the team pushed for a last minute effort to provide food for Syrian refugee children less than 18 hours before returning.

Any organisation or institution which is approved under subsection 446 will automatically be granted tax exemption on its income except dividend income under paragraph 13 Schedule 6 Income Tax Act 1967. Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government. Amount is limited to 10 of aggregate income Subsection 4411B 4.

Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions.

Buddhist Tzu Chi Merits Society Malaysia

Updated Guide On Donations And Gifts Tax Deductions

Related Image Organ Donation Donate Life Living Kidney Donation

Pdf Mobile Application Donate Day

Pdf Characteristic Affecting Charitable Donations Behavior Empirical Evidence From Malaysia

Don T Fall Prey To The Fake Charity Collectors Here S How To Identify

Support Our Programmes Mercy Malaysia

Source Of Information On Organ Donation Download Scientific Diagram

Updated Guide On Donations And Gifts Tax Deductions

Stakeholder Analysis To Determine The Key Decision Makers In Renal Download Scientific Diagram

Hati Toy Together Old And Young Is A National Inter Generational Community Charity Project Aimed To Improve Mental Health Among Underprivileged Children And Youth Cay Through Expressive Art Facilitated By Trained

Food Donation Yayasan Food Bank Malaysia

Support Our Programmes Mercy Malaysia

Pdf Organ Donation In Muslim Countries The Case Of Malaysia

Regulatory Requirement For Npos In Malaysia Download Table

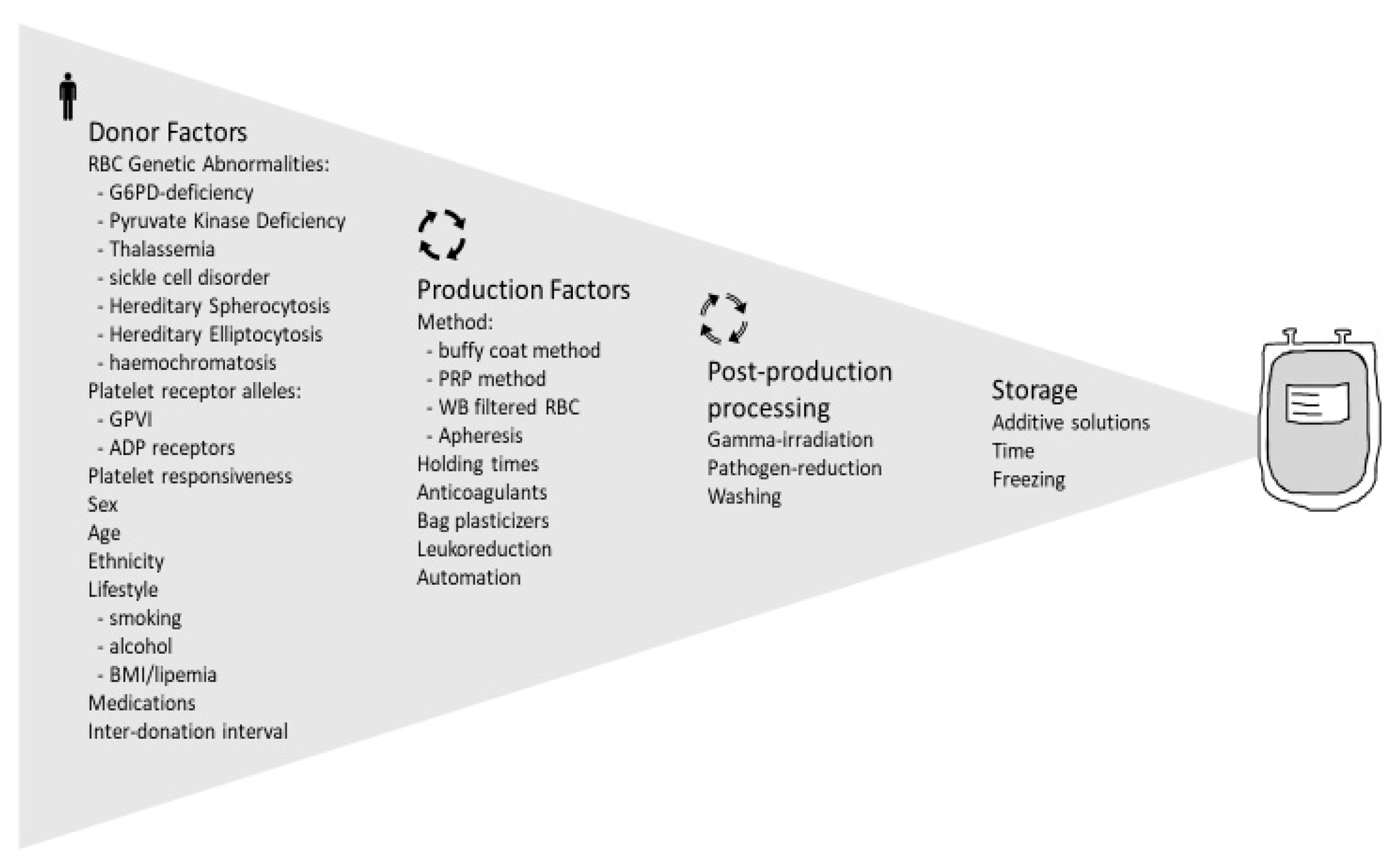

Ijms Free Full Text Current Understanding Of The Relationship Between Blood Donor Variability And Blood Component Quality Html

Ministry Fine Tunes Procedures The Star